Solon Will

Our Solon Will is designed to make Legacy Planning accessible for everyone. Whether you’re just starting your career, building a family, or managing multiple assets, we help you protect what matters most.

Easy Asset Management

Manage your assets effortlessly with our intuitive platform.

Unlimited Asset Distribution

List as many assets as you want, at no extra cost.

Easy Beneficiary Selection

Appoint loved ones with complete flexibility.

Legal Compliance

Drafted to meet Malaysia’s legal requirements.

Dedicated Support

Our team is here to assist whenever you need us.

Digital Vault

Informing loved ones where your written Will is stored at.

Professional Executor Backup

Free appointment of a professional executor.

Referral Program

Earn rewards when you share peace of mind.

Last Mile Donation

Include charitable donations to support causes you care about.

A Will that cannot be located is considered as have not written one. With our Will Custody+ service, your Will is kept safe and easily retrievable.

Biometric Protection

Your Will is safeguarded with biometric authentication, ensuring only authorized individuals can access it.

Preserved in Prime Condition

Stored in a controlled environment with regulated humidity, your documents remain intact and protected for years to come.

Round-the-Clock Security

24/7 monitoring with advanced surveillance, fire suppression, and flood prevention systems keep your Will safe from unexpected threats.

How It work

STEP 1

Sign Up

Create your account with just a few clicks.

STEP 2

Create Your Will

Provide your asset information and beneficiaries.

STEP 3

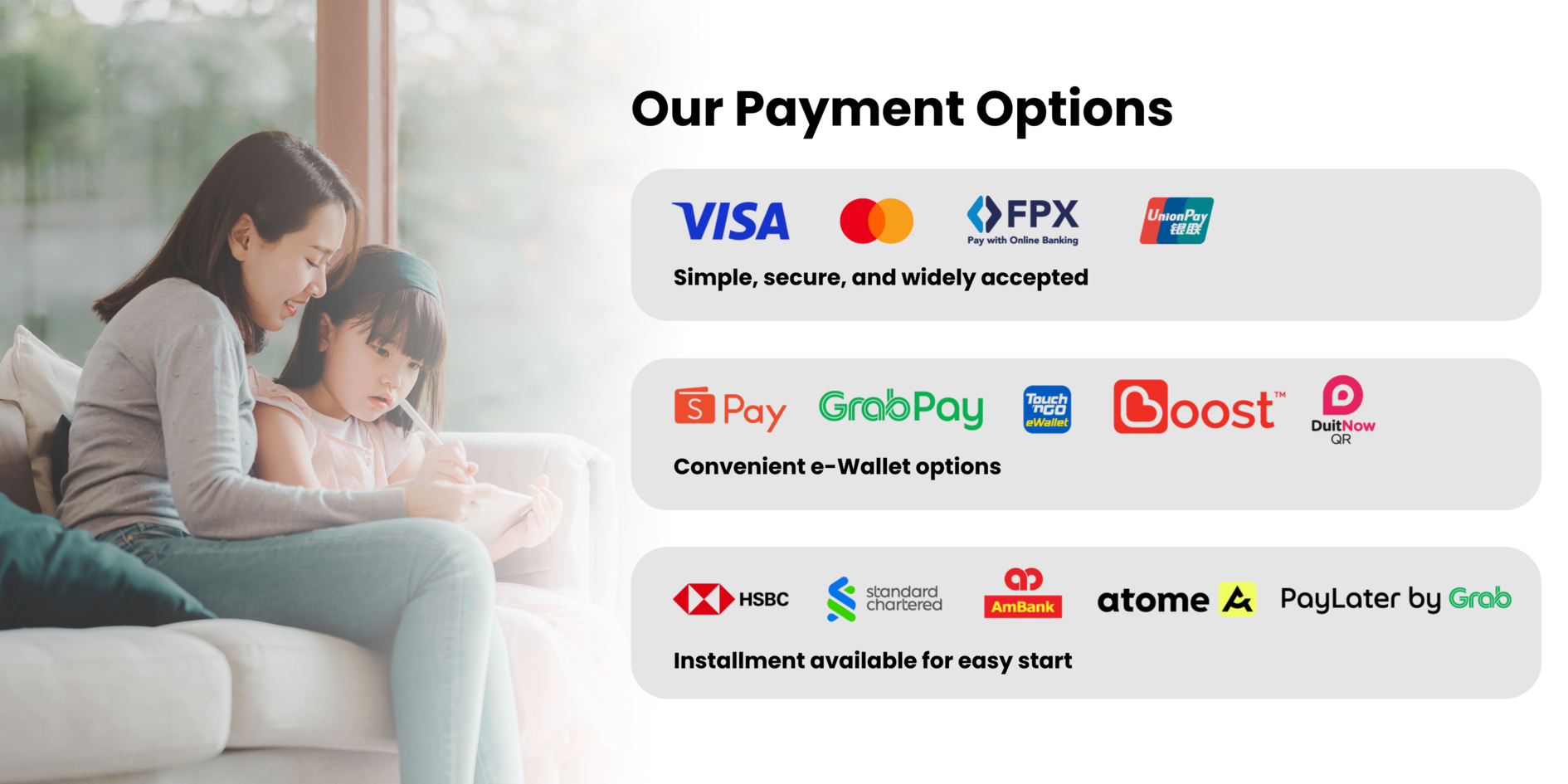

Make Payment

Choose your plan and complete the payment securely.

STEP 4

Sign And Seal Your Will

Sign your Will in the presence of two witnesses.Placed the signed Will into the Will

Custody+ envelope provided in your Welcome Gift.

How It work

STEP 1

Sign Up

Create your account with just a few clicks.

STEP 2

Create Your Will

Provide your asset information and beneficiaries.

STEP 3

Make Payment

Choose your plan and complete the payment securely.

STEP 4

Sign And Seal Your Will

Sign your Will in the presence of two witnesses.Placed the signed Will into the Will

Custody+ envelope provided in your Welcome Gift.

Affordable Pricing For Everyone

Basic Will

Priced at

RM9

Solon Will

(Most Popular & Trusted Solution)

(Most Popular & Trusted Solution)

From

RM 1088

to Promo

RM 688*

Will Custody+ by

Global Asset Trustee

(Most Commonly Bundled Product)

Global Asset Trustee

(Most Commonly Bundled Product)

From

RM 988

to Promo

RM 588*